Our investment philosophy is built on a robust Asset Allocation framework — the foundation for long-term, consistent results.

Why It Matters

Optimal Risk-Adjusted Returns

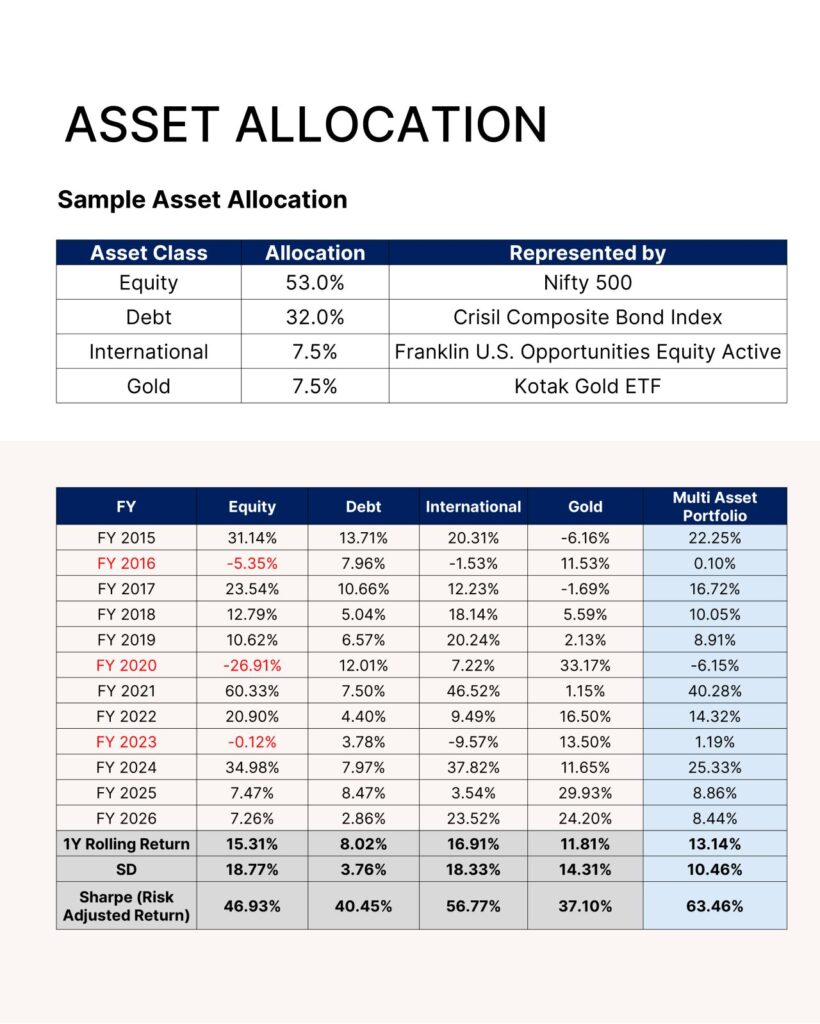

- Allocating investments across uncorrelated asset classes helps achieve superior risk-adjusted returns.

- This is often measured using the Sharpe Ratio, which evaluates return relative to risk.

Real-World Example

- A portfolio with predefined allocations and annual rebalancing across Equity, Debt, Gold, and International assets has historically demonstrated strong resilience.

- During FY 2020, when domestic equities fell -26.91%:

- Gold delivered +33.17%

- Debt and International exposures cushioned the downside

- This showcases the true value of diversification.

The Essence of Multi-Asset Investing

- A well-constructed multi-asset portfolio provides smoother returns and lower volatility.

- Compared to a pure equity portfolio, it helps investors stay invested confidently through market cycles.

Thinking Ahead

P.S. – Considering a review or adjustment of your asset allocation? Drop a comment below and let’s explore how to strengthen your portfolio structure.

Control Wealth Advisers