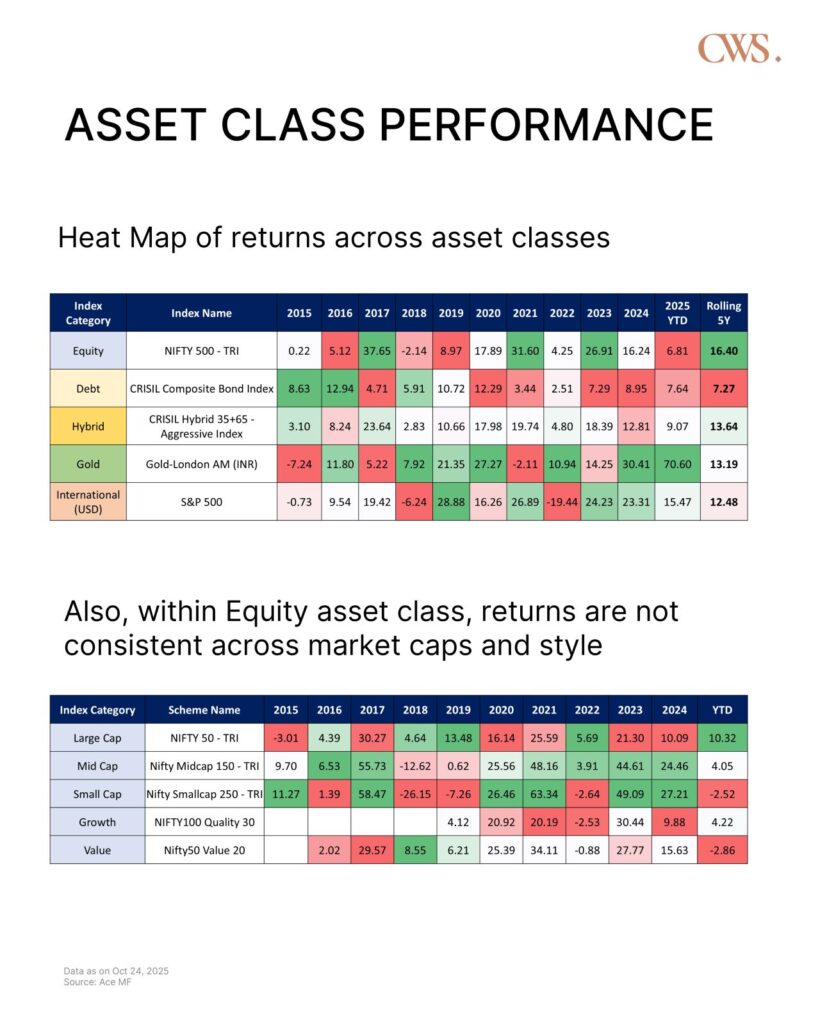

The table presents a heat map of returns across various asset classes, offering valuable insights into how different investments behave over time.

Key Insights

1. No Consistent Pattern Across Asset Classes

- Asset classes do not follow a predictable order of performance each year.

- This highlights the importance of a diversified asset allocation strategy.

2. Balanced Portfolios Provide Stability

- A well-diversified portfolio helps investors navigate various market cycles more comfortably.

- Though such portfolios may not always deliver the highest return in any single year, they provide steady, competitive performance across cycles.

3. Long-Term Performance Favors Equities

- Equities have delivered the highest long-term rolling returns at ~16.4%.

- This showcases the value of staying invested over longer horizons.

4. Not Always the Highest Performer — But Consistent

- Diversified portfolios may not rank #1 in short periods.

- However, they tend to perform competitively across market cycles, reducing volatility.

5. Diversification Within Equities Matters

- Maintaining a balanced allocation across market caps and investment styles is essential.

- It helps avoid concentration risk and improves long-term consistency.

Conclusion

Asset allocation—across and within asset classes—plays a critical role in building a resilient and stable investment strategy. A well-constructed diversified portfolio helps smoothen volatility and supports long-term wealth creation.

Control Wealth Advisers