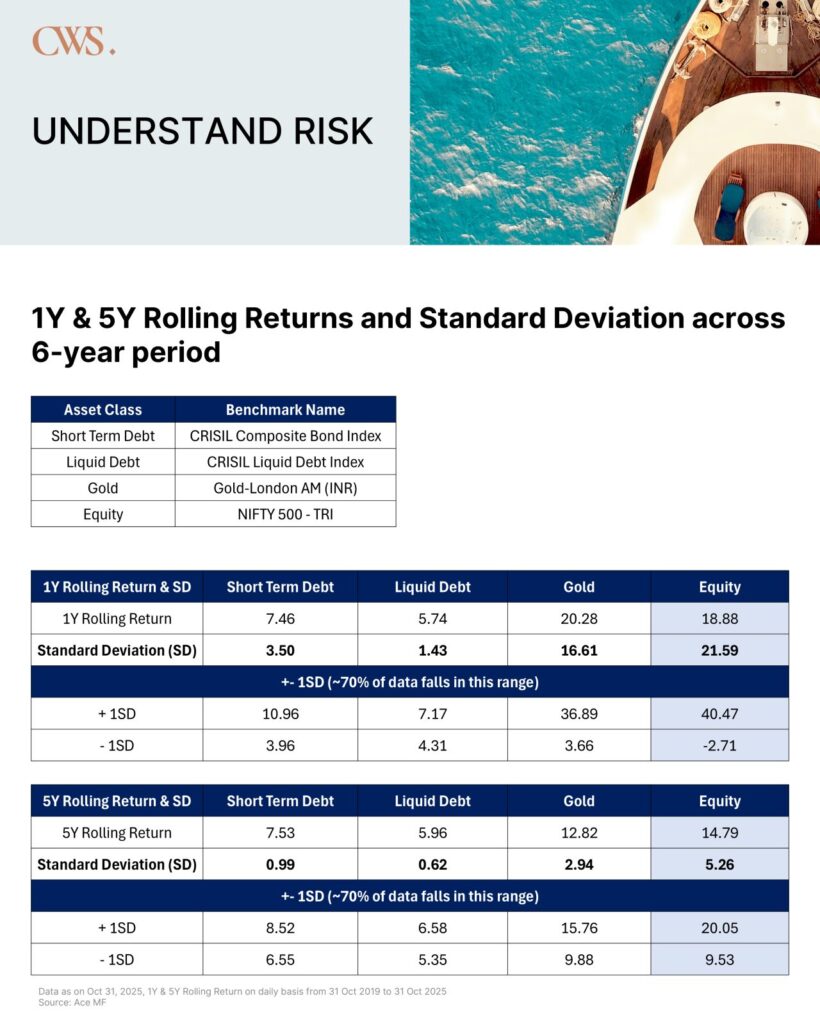

When it comes to investing, it’s important to know how much risk or volatility your asset class carries.

Risk simply means how much your returns can fluctuate—technically measured by standard deviation (how far actual returns move from the average).

Higher risk usually comes with the potential for higher returns—but also more ups and downs along the way.

That’s why time becomes your best friend, especially in equity investments. A longer holding period helps smooth out volatility and reduces the chance of short-term losses.

Let’s see how this plays out

If you invest in equities for 1 year:

- Average return: ~18.9%

- Possible range: -2.7% to +40.5%

- That’s a wide range—meaning high unpredictability.

If you stay invested for 5 years:

- Average return: ~14.8%

- Possible range: 9.5% to 20.0%

- Much narrower range—more consistent, less risky.

*Gold investment also needs a longer time horizon.

Takeaway:

If your goal is less than 1–3 years away, equity may not be ideal. Shifting part of your money to debt or hybrid options can provide stability and predictability.

Investing isn’t just about chasing returns—it’s about matching time horizon with the right asset class.

Control Wealth Advisers